Introduction

Understanding base formations in stocks is crucial for successful trading and investing. Among the various patterns, three stand out as particularly significant: the Double Bottom, Flat Base, and Cup and Handle. Let’s delve into each of these formations and unravel their importance in stock analysis.

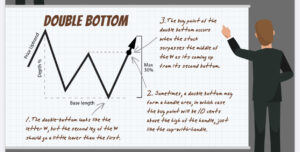

Double Bottom:

The Double Bottom pattern is a bullish reversal formation that typically occurs after a downtrend. It consists of two distinct lows that are roughly equal, separated by a moderate peak. This pattern signals a potential trend reversal, indicating that selling pressure has exhausted, and buyers are stepping in. Traders often look for a breakout above the peak between the two lows as confirmation of a trend reversal, providing an entry point for long positions.

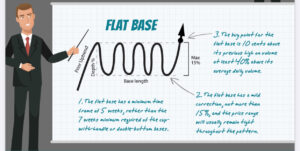

Flat Base:

The Flat Base is a consolidation pattern that forms when a stock takes a breather after a significant uptrend. It’s characterized by a period of sideways movement, where the stock price trades within a relatively narrow price range. This pattern represents a pause in the upward trend rather than a reversal. Traders watch for a breakout above the high of the base as a signal to enter long positions, anticipating the continuation of the prior uptrend.

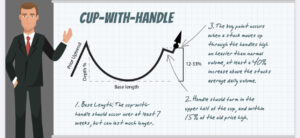

Cup and Handle:

The Cup and Handle pattern is a bullish continuation formation that resembles the shape of a teacup with a handle. It begins with a rounded bottom (the cup), followed by a short consolidation period (the handle) near the highs of the cup. This pattern signals a temporary pause in the uptrend before the stock resumes its upward movement. Traders typically look for a breakout above the handle’s high as confirmation of bullish momentum, providing an opportunity to enter long positions.

Conclusion:

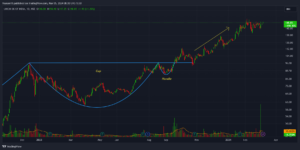

Mastering these three important base formations in stocks—Double Bottom, Flat Base, and Cup and Handle—can significantly enhance your trading and investing strategies. By recognizing these patterns and understanding their significance, you can make more informed decisions and capitalize on profitable opportunities in the stock market. Base formation can be continuation for of previous trend ( generally in flat base and cup and handle) or reversal of trend (This can be seen in Double bottom, Flat base and cup and handle). In a situation where there is strong trend, base formation is important to gather the energy to continue its journey. In case of reversal, V shape reversal can be dangerous, it should take some rest and gather some energy to change the trend. Remember to conduct thorough research and practice proper risk management techniques when incorporating these base formations into your trading strategy. With patience and discipline, you can leverage these patterns to your advantage and achieve success in the dynamic world of stock trading.

Read: Yes Bank- Buy | Sell ?? Flat base example

Leave a Reply