Basic fundamental checks.

There are two categories of companies: those that operate without debt (having taken no loans) and those that utilize loans to conduct business. From an investment standpoint, it’s not necessarily the case that debt-free companies are superior to those with liabilities. This blog will delve into this aspect.

Let’s begin by examining debt-free companies.

These companies rely on the equity of their promoters (their own funds) and are not obligated to pay interest to banks or lenders. This approach creates a sense of freedom from financial pressure, resulting in what we could call a stress-free business environment.

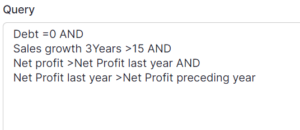

There’s no such thing as a completely stress-free situation. Imagine a scenario where sales are low and profits aren’t enough to cover business expenses. In such cases, the promoters’ funds could be drained, leading to significant stress. After all, no one wants to experience financial losses. So strictly from investment point of view if you want debt free company look for companies with consistently increasing Sales and Net profit. To screen this stock you can use screener.in. (Not promoting, I use it, feel free to use other screener).

I assume you’re investing in businesses rather than engaging in speculation, indicating a longer time horizon. Suppose you invest in Company A based on this principle. In that case, you should monitor it quarterly and assess whether the original premise of your investment still holds. Companies may decide to take on significant loans in the future for expansion, diversification, or other reasons. In such cases, you must ask yourself if you still want to be part of this business.

Now lets look at companies with debt.

There are many types of debts – long-term, short-term, etc. For simplicity, we will refer to them all as debt, as money has to be returned along with interest. Are all companies with debt bad? Not necessarily. We will delve into this aspect here. If a promoter has taken out a loan for business purposes, and the business is thriving with no issues in servicing the debt, then I don’t foresee any problems.

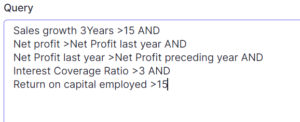

Here, we have maintained the same criteria for sales and net profit. If a company has debt, then we should assess its interest-paying capacity. A interest coverage ratio of 3 means its earnings before interest and taxes are three times the interest cost, which can easily help the company service its debt. Next is ROCE (Return on Capital Employed). In India, interest rates for various types of loans range from 8% to 14% per annum. Therefore, we are looking at companies generating in excess of 15%. You still need to check regularly if its original investment premise is still intact.

This is what I believe basic investment check. There is deep ocean to fundamentally analyze the company. Read book on fundamental analysis of stocks

Always prioritize risk management and proper position sizing to ensure you stay on track towards your goals. While analysis is valuable, it’s important to acknowledge that it may not always yield the expected results. Be prepared to adapt if things don’t go as planned, and maintain a resilient mindset throughout your journey.

Disclaimer: – I am not SEBI registered advisor. Please consult a professional advisor before taking any decision. This is not buy/sell recommendation.

Leave a Reply