Definition of Risk of Ruin

It’s the probability that a trader will lose all of their capital before making a profit. This risk arises from consecutive losses that deplete the trading account.

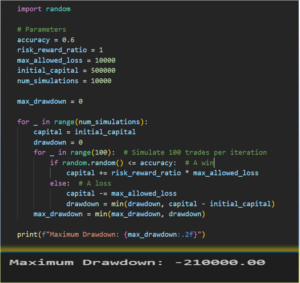

Monte Carlo Simulation for Risk Assessment

Monte Carlo simulation is used to assess the Risk of Ruin. By running thousands of simulations, traders can estimate the likelihood of different outcomes and determine the capital needed to withstand adverse market conditions.

Parameters for the Simulation

I have Specified the parameters used in the simulation, such as the win rate (accuracy) and the risk-reward ratio. In example, the strategy has a win rate of 60% and a risk-reward ratio of 1:1. These parameters influence the probability distribution of returns and the potential for drawdowns. This parameter is generally true for those who do option selling (straddle and strangles)

Calculation of Risk of Ruin

Risk of Ruin is calculated based on the simulation results. This involves analyzing the distribution of account balances over the simulated trades and identifying the probability of experiencing a total loss.

Importance of adequate capital

If you possess a capital of 5 lakhs and employ a trading system with 60% accuracy and a 1:1 risk-reward ratio, you may experience a drawdown of 2.1 lakhs, which equates to approximately 40% of your capital. The question then arises: Do you possess the resilience to endure this phase? I am neither affirming nor negating the effectiveness of this system. Conversely, if you had a capital of 10 lakhs and assumed the same level of risk, your overall drawdown would be approximately 20%, a less stressful scenario compared to being undercapitalized. This underscores the significance of having adequate capital in the market.

Risk Management Strategies

Emphasize the importance of implementing effective risk management strategies to reduce the Risk of Ruin. This includes setting stop-loss orders, diversifying the portfolio, and avoiding over-leveraging. These measures help protect the trading capital from excessive losses. By analyzing the distribution of returns and implementing effective risk management techniques, traders can better assess the viability of their strategies and protect their capital from the risk of ruin.

Read more on risk management here: https://amzn.to/3Q1hqMF

Leave a Reply Cancel reply