HDFC Bank has shown no significant movement over the past two years. While I’m not an expert banking analyst and prefer to avoid complex jargon, I’ll provide a few key data points.

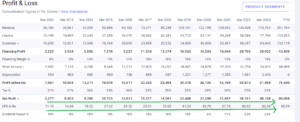

I think the most important thing to look at in fundamental analysis is how much money the company is making. In the image above, you can see that the profits, revenue, and earnings per share are all going up.

The sales are growing well, profitability and Return on Equity (RoE) are very steady, but the price remains unchanged.

That doesn’t mean it will move now. Reliance was in decade long consolidation from 2007 to 2017, then when broke out it gave 5x in 5 years (Read more). In last image I have plotted anchored VWAP from 2020 onward, it show average buy price of all participants from that year onward, right now price is touching its 3 year average, usually what happens is large participant does not allow price to fall below its average buying price. Therefore, I believe HDFC Bank is at a strong support level.

This is not the market to go all in, I think investing in staggered manner makes sense.

I acknowledge that this analysis may not provide a comprehensive view of the stock. However, I primarily track simple data points. I welcome feedback and understand that I could be mistaken. As a learner, I’m open to additional insights and corrections if I’m wrong.

Always prioritize risk management and proper position sizing to ensure you stay on track towards your goals. While analysis is valuable, it’s important to acknowledge that it may not always yield the expected results. Be prepared to adapt if things don’t go as planned, and maintain a resilient mindset throughout your journey.

Disclaimer: – I am not SEBI registered advisor. Please consult a professional advisor before taking any decision. This is not buy/sell recommendation.

Leave a Reply