In today’s market analysis, we’ll delve into the dynamics of supply and demand within the stock market.

Let’s start with a chart of Nifty 50. Nifty 500 and Nifty Bank and mid and small-cap index.

In today’s market analysis, 50-daythe Simple Moving Average (SMA) serves as a crucial indicator for me, providing a snapshot of the market’s overall trend. When the Nifty comfortably exceeds its 50 SMA, you can bet big, whereas caution is warranted if the Nifty falls below this threshold. Presently, the Nifty hovers close to its 50 SMA, but broader indices like the Nifty 500 and Mid/Small Cap index have notably breached this line. In contrast, the Nifty Bank remains above its 50 SMA, experiencing a less turbulent decline compared to other indices.

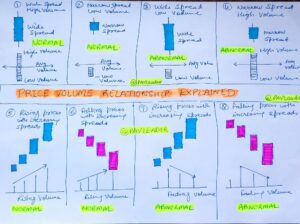

Now let me share some charts of stocks that I track regularly (Not necessarily holding) and let’s try to understand demand and supply. I feel price and volume are not in sync.

Renowned YouTuber Mr Vivek Bajaj shared his insights today on X, a perspective I find fitting for the current market conditions

“A natural correction was anyways happening, this looks like a forced correction. Because of a lack of liquidity when stocks fall, the pain gets magnified by extreme volatility. There is a serious need to increase cash market depth just like we have focused on daily options.”

Always prioritize risk management and proper position sizing to ensure you stay on track towards your goals. While analysis is valuable, it’s important to acknowledge that it may not always yield the expected results. Be prepared to adapt if things don’t go as planned, and maintain a resilient mindset throughout your journey.

Leave a Reply