Introduction

Gold imports in India amount to approximately $36 billion, and this figure has been on a rising trend for many decades. While gold importation offers numerous benefits such as meeting demand, investment diversification, and cultural significance, its negative impacts are substantial, including trade deficit, currency depreciation, current account deficit, capital outflow, and more.

- India’s Fascination with Gold:

India has held a deep fascination for gold throughout its history. Understandably so, as it is one of the few assets with intrinsic value. Unlike stocks, bonds, or currency notes, which may lose value if the issuing party defaults, gold retains its utility and worth over time. Read Why should you buy Gold?

- Investing Options:

For those who prefer not to hold physical gold, there are alternative options such as gold-focused mutual funds and exchange-traded funds (ETFs). Gold ETFs, in particular, offer investors the ability to invest in gold in fractional amounts, with their prices closely tracking the value of gold.

- Sovereign Gold Bonds (SGBs):

Additionally, there is the Sovereign Gold Bond (SGB) issued by the Government of India. This option provides marginally better returns than gold funds, is backed by the government, and offers tax benefits on price appreciation.

Using the SGB Analyzer:

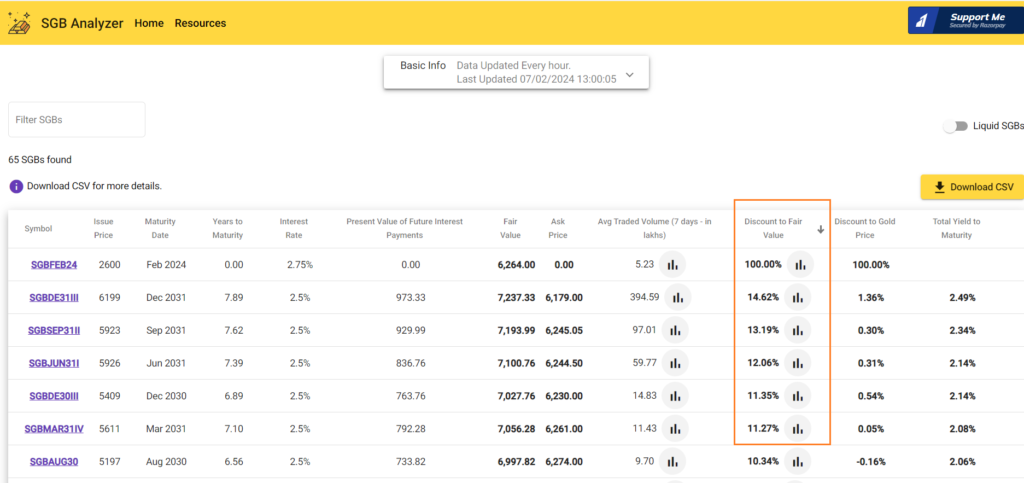

To illustrate how to invest in SGBs, we’ll introduce a tool called the SGB Analyzer. By visiting the website https://sgbanalyzer.com/home, investors can access a comprehensive list of government-issued bonds with various maturities, current market prices (CMP), and the interest rates provided by the government.

Investment Strategy:

The SGB Analyzer also displays the discount to the current gold price and the discount to the fair price, calculated based on the value of gold if held to maturity. Investors can sort the bonds by the discount to fair value and consider purchasing those with the maximum value, typically within the top three options. It’s advisable to check for liquidity and invest with the intention of holding the bond until maturity.

Conclusion:

It’s essential to note that SGBs are not trading instruments due to their limited liquidity. However, holding SGBs offers the advantage of pledging them with a broker and trading in the futures and options (F&O) market. For skilled and consistent traders, this can significantly improve the return on investment (ROI).

Leave a Reply Cancel reply