Technical analysis plays a crucial role in helping traders identify potential buying and selling points in the stock market. One key technique within technical analysis is understanding how to trade channels. A prominent strategy within this realm is the Upper Channel Line Break Sell Rule. Let’s break it down.

What is an Upper Channel?

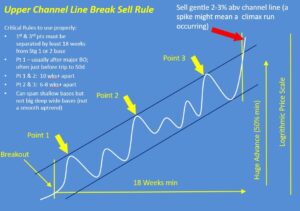

Within a stock chart, an upper channel is formed by connecting two parallel trendlines. The upper trendline connects recent price highs and the lower trendline connects recent price lows. The channel must slope upwards to illustrate an existing uptrend. For more click here.

The Sell Signal: How to Trade Channels

The Upper Channel Line Break Sell Rule generates a sell signal when the stock price breaks above the upper channel trendline. This breakout suggests the uptrend may be losing momentum and a potential reversal could occur.

Confirmation Rules for Trading Channels

To increase signal reliability, traders often use these confirmation rules:

- Rule 1: Points 1 and 3 of the chart pattern should have roughly 18 weeks between them, occurring after Stage 1 or Stage 2 bases (consolidation periods).

- Rule 2: Point 1 usually happens following a breakout, sometimes with the price near its 50-day moving average (a short-term trend indicator).

- Rule 3: There should be approximately 10 weeks between points 1 and 2, and 6-8 weeks between points 2 and 3.

Important Considerations for Trading Channels

The Upper Channel Line Break Sell Rule works well with stocks showing slight upward movements. Avoid using it during strong uptrends or extended consolidation phases.

Technical Analysis: One Piece of the Puzzle

Remember, technical analysis, including strategies like the Upper Channel Line Break Sell Rule, should be viewed as a helpful tool, not an absolute predictor. Before making any investment decisions, always consider fundamental analysis – examining a company’s financial statements and overall business operations.

Understanding how to trade channels, specifically through techniques like the Upper Channel Line Break Sell Rule, can help traders identify potential selling opportunities. By studying trendlines, breakouts, and confirmation patterns, traders can make more informed decisions about when to potentially exit positions. Successful trading often combines both fundamental and technical analysis approaches.

Read:

Disclaimer: This article is for educational purposes only. Stock trading involves risk. It’s essential to conduct thorough research and consider your own risk tolerance before making investment decisions.

Leave a Reply Cancel reply