NSDL and CDSL: The Backbone of India’s Securities Market

India’s remarkable economic growth and the increasing participation of individuals and institutions in the stock market wouldn’t be possible without the critical infrastructure provided by NSDL and CDSL. These two depositories form the backbone of the Indian securities market, ensuring safe, efficient, and transparent transactions.

What are Depositories?

Gone are the days of physical share certificates. Today, stocks, bonds, and other securities are primarily held in dematerialized (electronic) form. Depositories like NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited) are the custodians of these dematerialized securities. They operate much like banks, but instead of holding currency, they hold investors’ securities in accounts called DEMAT accounts.

The Nature of Their Business

The primary services provided by NSDL and CDSL include:

- Dematerialization and Rematerialization: Converting physical securities to electronic form and vice-versa.

- Holding and Settlement: Maintaining records of ownership and facilitating the transfer of securities between buyers and sellers after a trade occurs on the stock exchange.

- Corporate Actions: Processing corporate events like dividends, stock splits, mergers, and bonus issues in coordination with companies.

- Pledging/Unpledging: Enabling the use of DEMAT holdings as collateral for loans.

The Duopoly and Moats

NSDL, established in 1996, was the first depository in India and holds the larger market share. It’s associated primarily with the National Stock Exchange (NSE). CDSL was established in 1999 and is connected more closely with the Bombay Stock Exchange (BSE). Together, these two depositories dominate the Indian market with a strong moat around their businesses.

- Market Share: NSDL holds approximately 55-60% of the market share in terms of active Demat accounts, while CDSL accounts for the remaining 40-45%.

- High Entry Barriers: Setting up a depository requires significant infrastructure, technical expertise, regulatory approvals, and a vast network of Depository Participants (DPs). This creates a high barrier to entry for new players, further solidifying the position of NSDL and CDSL.

Tremendous Growth

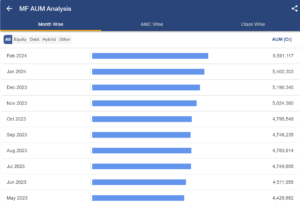

The Indian depository system has witnessed tremendous growth, reflecting the increasing vibrancy of the country’s financial markets. As shown in the bar chart you provided (I can’t include images directly, but the data you have is helpful), the number of Demat accounts has grown significantly, indicating wider investor participation. Similarly, the bar chart also highlights the substantial growth in mutual funds’ Assets Under Management (AUM), signifying a rise in investor interest in wealth creation through mutual funds.

Why This Matters for Investors

If you believe in India’s promising financial market future, then NSDL and CDSL, along with the trends they represent, are a theme worth considering. Here’s why:

- Growth Potential: The Indian stock market is expected to continue growing, driven by a young population, rising disposable incomes, and increasing financial literacy. This growth will likely translate to even more Demat accounts and higher AUM in mutual funds, benefiting the depositories.

- Stable and Secure: NSDL and CDSL’s duopoly provides a stable and secure infrastructure for investors, fostering trust and encouraging participation.

Challenges and Considerations

- Potential for Further Competition: Some experts believe the market could benefit from additional players to introduce greater competition and further reduce service costs.

- Regulatory Oversight: SEBI, the market regulator, plays a crucial role in ensuring the efficient and fair operation of depositories.

Conclusion

NSDL and CDSL play a pivotal role in the development of India’s financial markets. Their services ensure the security and ease with which investors can buy, sell, and hold a wide variety of securities. Their duopolistic structure, coupled with the significant growth in Demat accounts and mutual fund AUM, paints a promising picture for India’s financial future. By understanding this ecosystem, investors can make informed decisions to participate in this growth story.

Please note NSDL is not listed entity

Always prioritize risk management and proper position sizing to ensure you stay on track towards your goals. While analysis is valuable, it’s important to acknowledge that it may not always yield the expected results. Be prepared to adapt if things don’t go as planned, and maintain a resilient mindset throughout your journey.

Disclaimer: – I am not SEBI registered advisor. Please consult a professional advisor before taking any decision. This is not buy/sell recommendation.

Leave a Reply Cancel reply